Gambling

Related Essays and Reports by Andrew W Scott

The DPP takes over Tabcorp prosecution,

then drops it

September 13th 2007

Nicholas Cowdery, the NSW Director of

Public Prosecutions, has just made what could only be

described as a bizarre decision. Mr Cowdery's decision

will be heartily welcomed by Tabcorp and the NSW Labor

Government, but has devastated one Chris Fitzsimons.

Who's Chris Fitzsimons? He's the former

Chatswood solicitor who wagered more than $10 million

from 2002 to 2006, punting on horses while utilising

a credit betting facility extended to him by the NSW

TAB. He now faces bankruptcy, has lost his practice

and owes more than $1 million to family and friends.

The credit betting facility was continued by Tabcorp

after it took over the TAB in 2004.

'But isn't credit betting illegal?'

I hear you ask. Yes, credit betting is banned in almost

all spheres of gambling in Australia, including at

TAB Agencies throughout NSW. It is also against the

stated policy of the NSW Government. But in secret

discussions in 2002 between then Gaming Minister Richard

Face and the TAB, the TAB cried poor and said gaming

tax revenue was under threat, unless it was able to

offer credit. Despite initial denials and then protestations

of amnesia about the matter, it is a matter of public

record that Face caved in, authorising credit betting

on Sep 2nd 2002, utilising a little known loophole

in the Totalizator Act.

The TAB then got to work, offering

its shiny new credit facility to some 350 'Special

Account Customers', including adman and racing identity

John Singleton. Chris Fitzsimons was also one of the

'special' who was offered credit betting.

An internal information paper for

the eyes of the TAB Board reported Ernst &

Young had estimated an increase in betting

turnover of $10 million for just the first 15 customers

to be offered credit. Extrapolate that to 350 customers

and we are talking an extra $233 million

a year in betting.

Within gambling circles credit betting

is generally acknowledged as a great way for gambling

providers (and thus Governments, through gaming taxes)

to make more money, but it's devastating to problem

gamblers. When a person bets with their own money,

they can still come home with an empty pocket, but

at least they don't come home with an unpayable debt,

and the terrible consequences that arise from that

debt. Normally a punter can't instantly liquidate

the family home and bet it on a horse race in a moment

of madness, but with credit betting any such moment

can lead to the loss of all assets, subsequent bankruptcy

and destroyed lives.

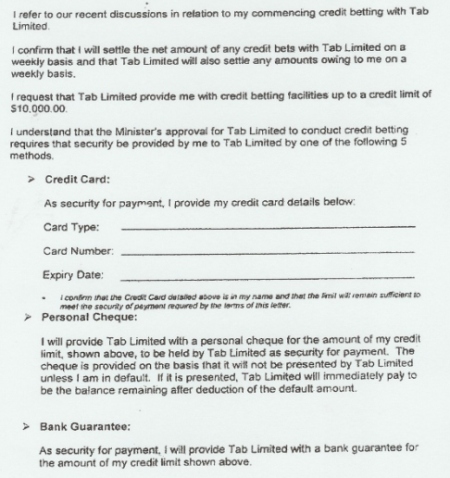

The TAB initially gave Fitzsimons

credit of $5,000 a week. As Fitzsimons continued to

lose it offered him $10,000 a week, then $20,000 a

week: Fitzsimons claims they eventually said, 'tell

us what you want and we'll give it to you'.

Fitzsimons claims a litany of illegal,

deceptive and unconscionable conduct by the TAB over

the period in question, and has a mountain of paperwork

to support his claims.

As a result of this conduct, Fitzsimons

wanted to commence criminal proceedings against TAB

Ltd and Tabcorp. He satisfied the Registrar of the

Downing Centre Local Court of the bona fides of the

case, and was allowed to prosecute 11 charges under

the Crimes Act, including obtaining money

or financial advantage by dishonest deception. He

wrote to the DPP on 6 August this year, requesting

that Mr Cowdery take over the prosecutions. Cowdery's

response was to ask Fitzsimons for a brief, which

was supplied. The case was then put on the DPP's court

list for 27 September.

Fitzsimons was delighted with the

prospect of the DPP taking over the prosecutions,

as the DPP has investigative powers not available

to a private prosecutor, and would therefore be likely

to unearth further evidence of Tabcorp's wrongdoing.

Fitzsimons offered to be interviewed and to assist

the DPP in any way he could.

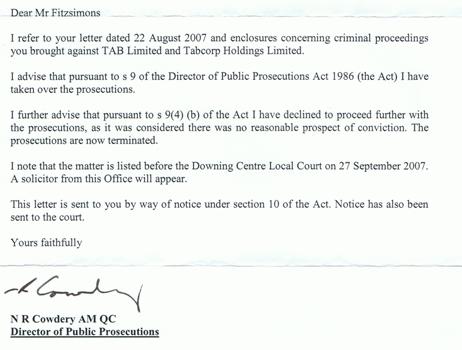

Imagine Fitzsimons' shock then, when

yesterday he received this letter from the DPP:

The DPP has taken the extraordinary

step of taking over the prosecution, merely so that

he can abandon it. The only reason given was 'it was

considered there was no reasonable prospect of conviction.'

The DPP didn't even bother to interview Fitzsimons

or examine all the evidence he had.

Fitzsimons is now out in the cold.

The DPP's decision means he can no longer pursue the

charges, and he has no avenue of appeal. Fitzsimons

practiced as a criminal solicitor for 35 years, so

certainly has the requisite skills to proceed. He

was not wasting the Court's time, there was a mountain

of evidence involved and a prima facie case

against the TAB. His right to proceed had already

been confirmed by Magistrate O'Shane in an earlier

strike-out motion.

Mr Cowdery's decision effectively

gags Fitzsimons and suppresses all the nasty detail

that would have come out in Court about the secret

credit betting deal done between the NSW Government

and the TAB.

Fitzsimons claims that the Attorney

General has leaned on the DPP to keep the matter quiet.

While this may or may not be true, there is certainly

an appearance here that the DPP wants this matter

buried, and buried quickly. Why take over a case,

just in order to ensure it was dropped?

While the story of ICAC's uncovering

a public housing official taking bribes in the hundreds

of dollars makes it to the papers, efforts appear

to be afoot to keep quiet more serious matters involving

hundreds of millions of dollars and the NSW Government

itself.

Mr Cowdery, if there was no reasonable

prospect of conviction, why not let justice take its

course? Why not allow the Court to make that decision?

Why go to such extraordinary lengths to keep this

matter out of the Courts and out of the media?

What is it that someone is trying

to hide?

Were you offered or involved with

credit betting by the NSW TAB, probably in 2003 or

2004? If you were, I would love to hear from you.

E-mail Andrew Scott

©

2007 Andrew W Scott

Home|FAQs|Disclaimer|Contact

Us

©2000 to present.

OZmium Pty Ltd. All rights reserved